As the People's Advisor, my client's best interest is paramount and at the center of my recommendations for them. I pride myself on being an honest and personable guide for my clients.

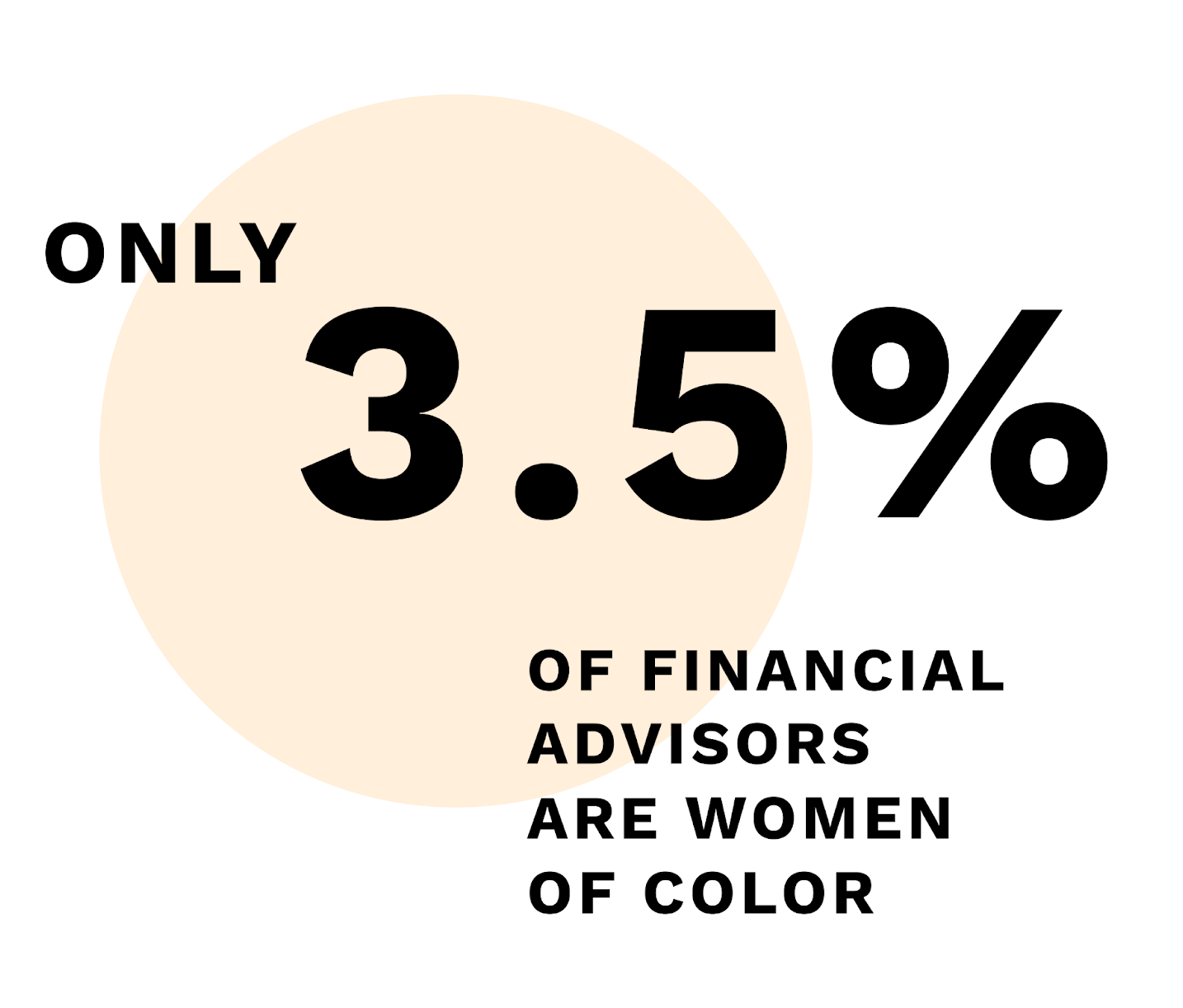

Only 3.5% of Financial Advisors are Women of Color.

You deserve to work with someone who understands your perspective and unique challenges, so the recommendations are appropriate for your situation.

See below some of the many ways I can help you increase your chances of success and strategically plan for your future.

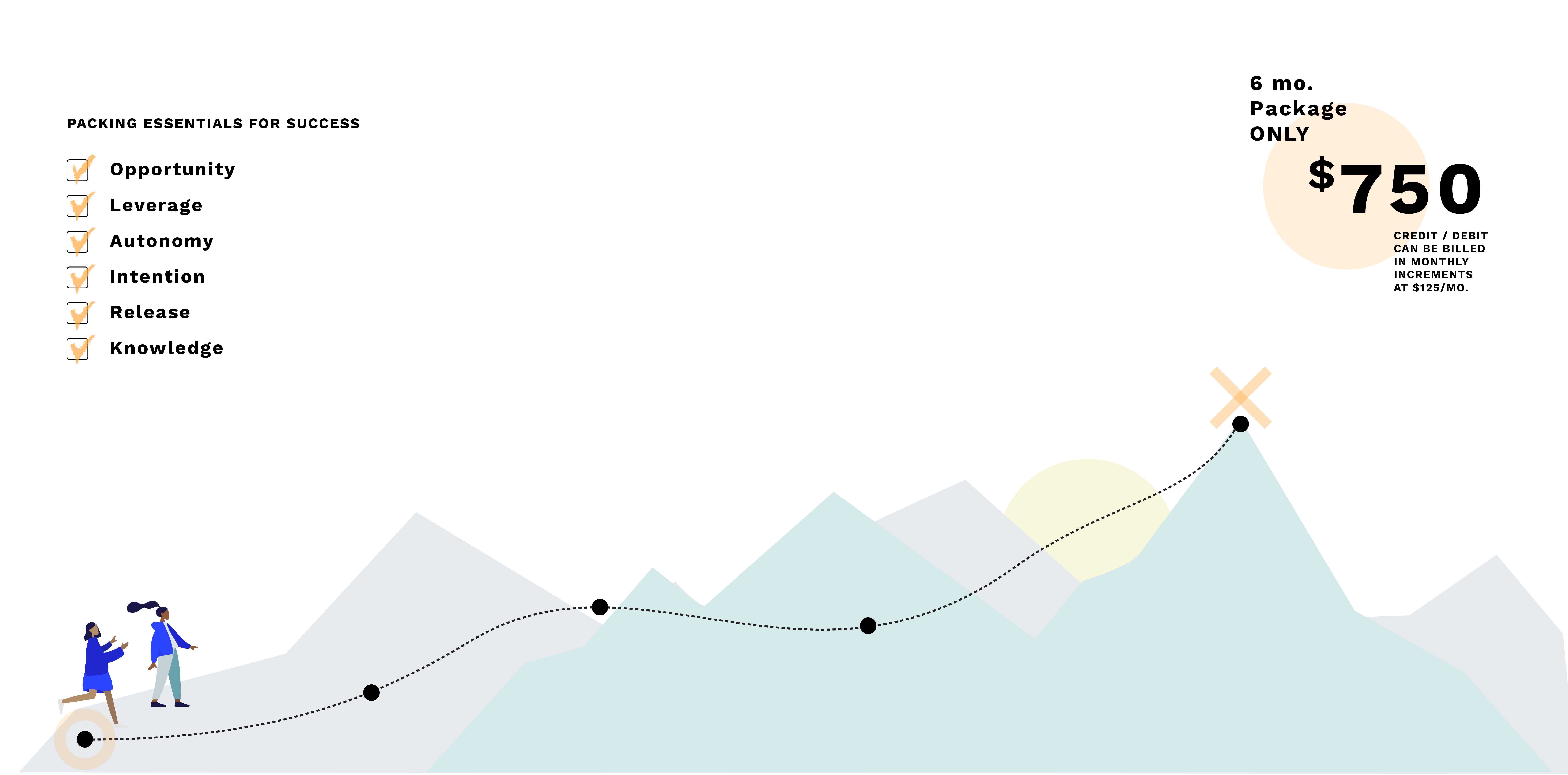

The Trek Toolkit (For Emerging Adults):

Ready to climb the mountain of financial literacy? Every mountaineer needs a guide. That’s where a financial advisor comes in. Before embarking on the journey, you need to ensure you have all the equipment. On this journey, you’ll need Opportunity, Leverage, Autonomy, Intention, Release, and Knowledge. Have a look at our step-by-step process:

-

Part 1: Understanding how to invest

-

Nowadays, everyone seems to be advising on stocks. There’s a growing number of “Financial Influencers” who have zero qualifications, and have to label their content as “opinion.” Like discovering plants on a hiking trail—these videos or posts might look easily digestible, but they are poisonous. With Monique and her team at Higher Ground Financial Services, you will gain Knowledge of Investing 101 from a professional. Nothing compares to the credibility of a registered Financial Advisor who has the responsibility of fiduciary.

-

Part 2: Financially planning for a goal

-

Think of “X” on the map as your goal. To get to it, you need to ensure you’re pointing your compass in the right direction. On your financial journey, a budget is your guide. Having one can protect you from impulse spending, and allow for expense analysis. With the help of Monique, her team at Higher Ground Financial Services, and special access to planning tool MyBlocks*, you can set your Intention. Welcome to budgeting with purpose!

-

Part 3: Living life by your terms

-

These times prove we’re always trying to control the uncontrollable. In the pursuit of taming money concerns, we miss out on the joys of our life’s expedition. With Autonomy, we’re free to explore our goals, tackle our fears and put a plan in place. This category introduces you to building emergency funds and other personal finance essentials. It’s time to go beyond trying to survive.

-

Part 4: Priming yourself to access your financial opportunities

-

After years of practicing on the indoor rock wall, you’re ready to scale the mountain. However, the classroom might have shielded you from employment disparities. With Monique and her team at Higher Ground Financial Services, you’ll learn how to optimize your professional skills to take on these hurdles. Some highlights include how to strategically build a network of mentors and sponsors, and how to evaluate a job offer. Let’s turn theory into practice for your next career Opportunity.

-

Part 5: Making the most of your benefits package

-

Imagine being handed a map written in an unfamiliar language. Would you ask for a translation or blindly follow? The same applies when you are discussing your benefits package with your employer. How can you make the most of your benefits package if you can’t decipher it? With Monique and her team at Higher Ground Financial Services, you can decode your benefits package. Understanding what you’re being offered is your Leverage.

-

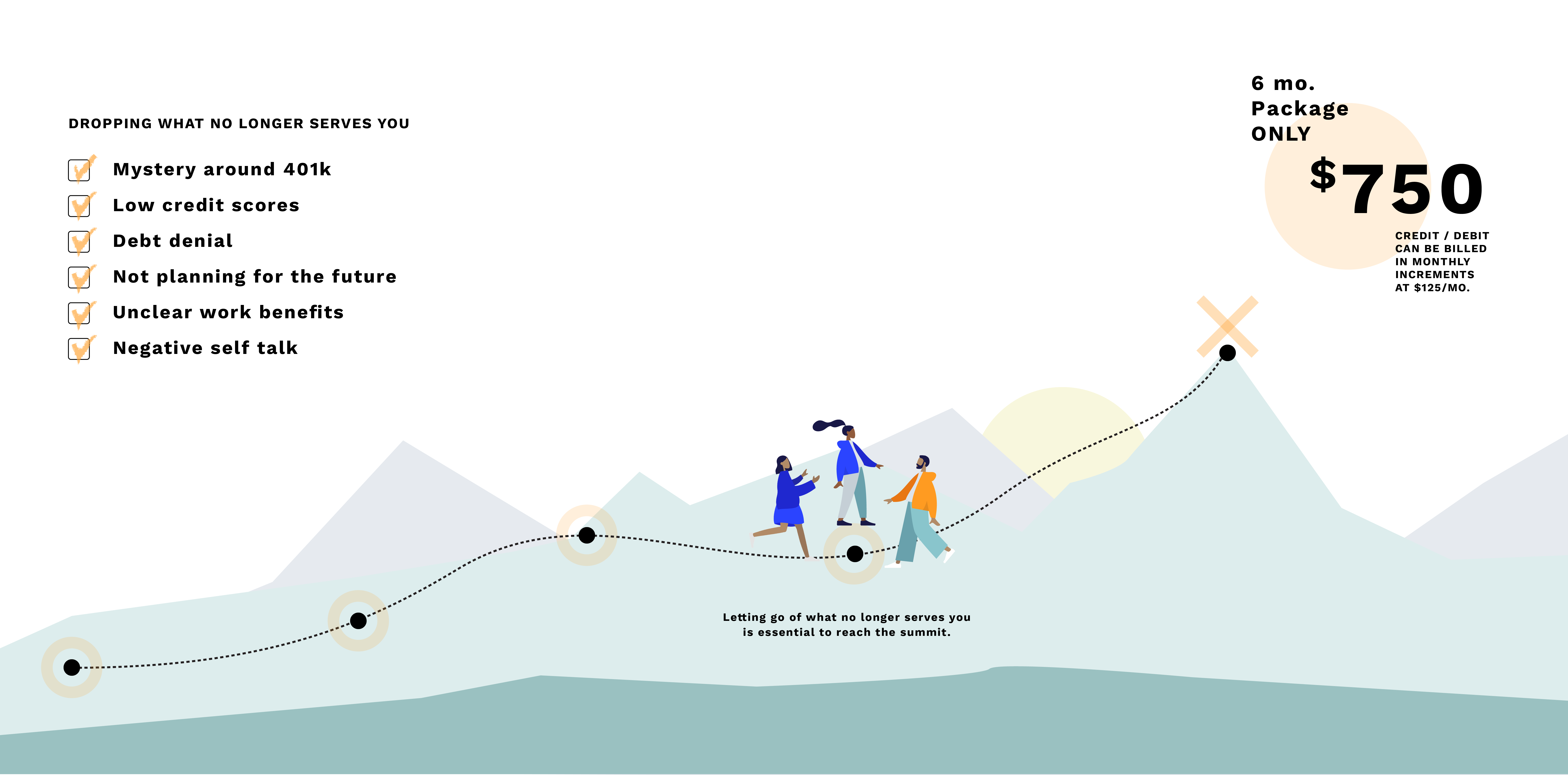

Part 6: Eliminating low credit scores

-

Imagine hiking with a backpack full of rocks. Having bad credit can feel like a burden. Yet, not having credit can block you during your financial journey. It’s essential to understand how credit works. Monique and her team at Higher Ground Financial Services will teach you the role of credit and strategize on how it can serve you best. Through our personalized guidance of the MyBlocks* tool suite, we can plan to minimize credit card and student loan debt. Release low credit scores and welcome financial flexibility.

*part of the comprehensive financial planning tool suite of MoneyGuidePro. MyBlocks helps clients gain answers to financial questions via interactive modules and calculators.